Since 1987, Dynamic Trend has been developing Stocks, Options and Futures Trading Platforms. Now with Patented Options features not available anywhere else.

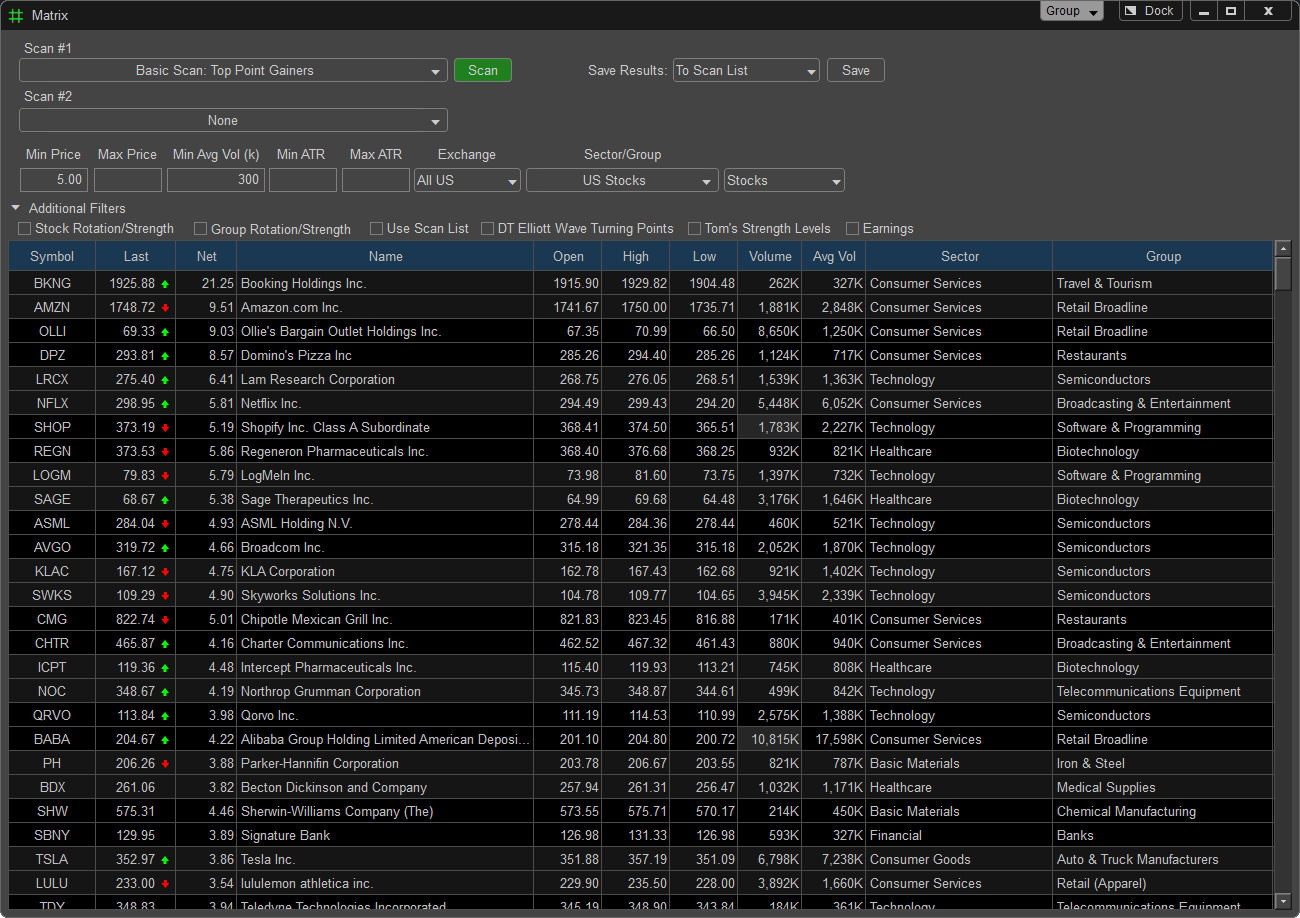

The Dynamic Trend Trading Platform gives any type of trader a full set of tools to identify, analyze and manage all types of trade setups.

Whether you are a day trader, short term trader, swing trader, long term trader or just managing your retirement account, see how you can use the Dynamic Trend software to make better decisions.

Free Options Trading Webinar

Join us for a FREE live weekly webinar with Tom Joseph. See how you can use the Dynamic Trend software to identify directional options trading opportunities for both short-term and long-term.

**New Feature - Zero DTE Options Trading (0DTE)

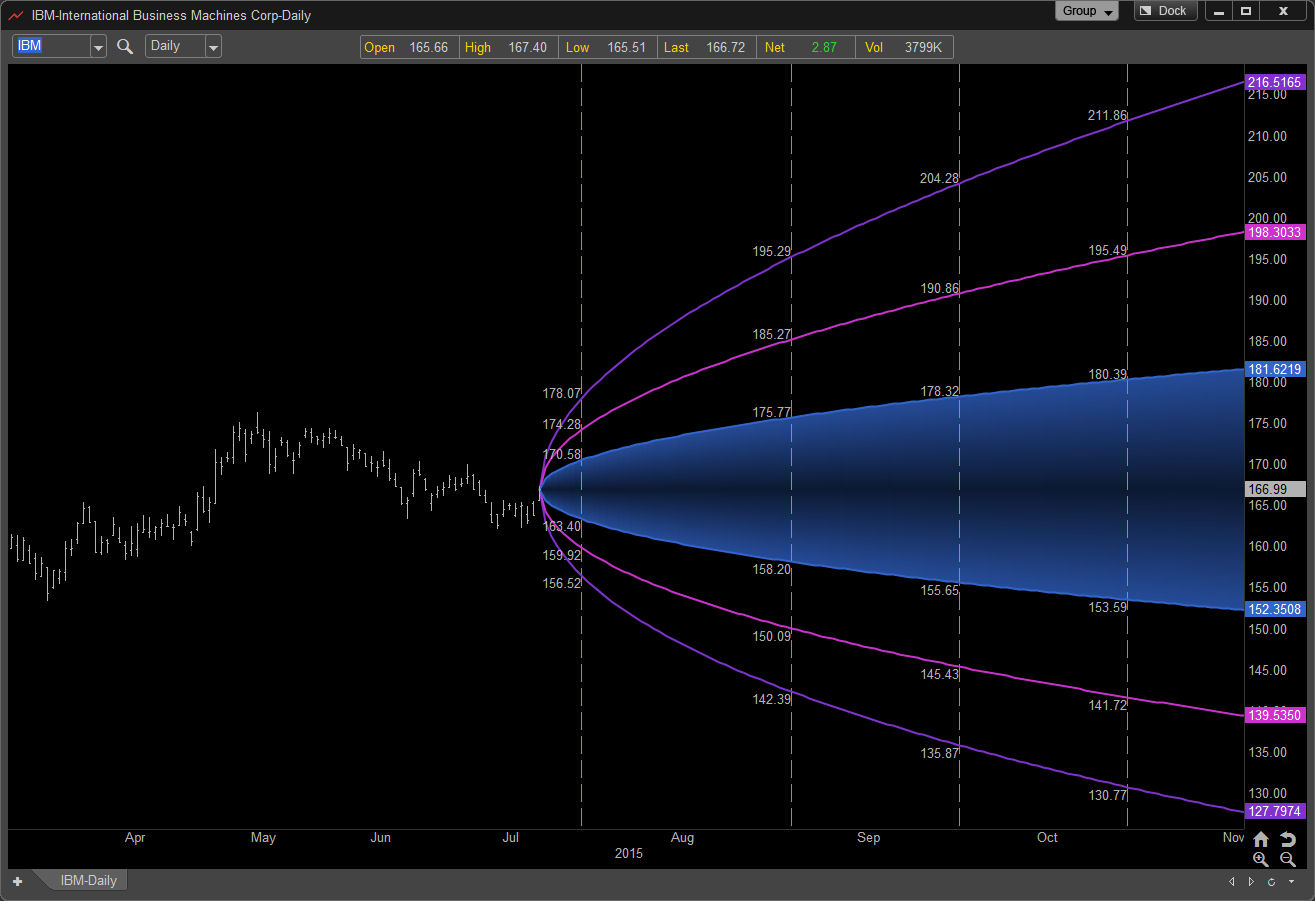

Market Indexes or very Active stocks with near term weekly options expirations tend to trade up or down in seemingly random moves to some price level only to reverse course on a dime. Our extensive research shows this phenomenon is mainly a result of Gamma Induced Squeeze levels on near term expiring options.

We have developed a unique method to combine multiple strikes and expirations to create a DT Gamma Squeeze Index. The DT Gamma Squeeze Index is either positive or negative.

DT Options Volume Sentiment

- Proprietary arrangement of Call and Put Buying Sentiment

- Algorithm looks inside each bar for Options volume

- Covers multiple strikes across both Calls and Puts

- Ability to start accumulated volume at any period in time

- Multiple modes allowing you to see total volume or just Call and Put buying

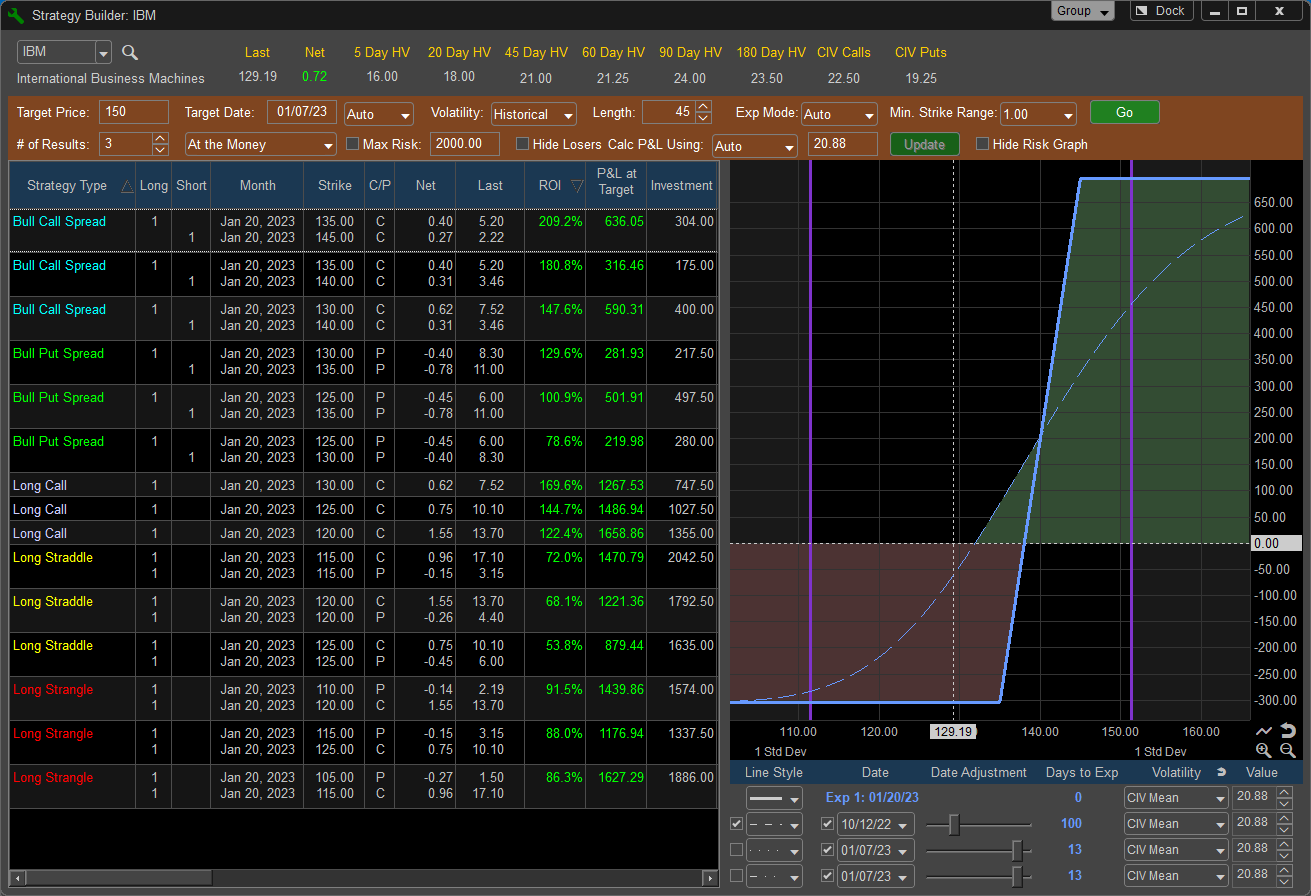

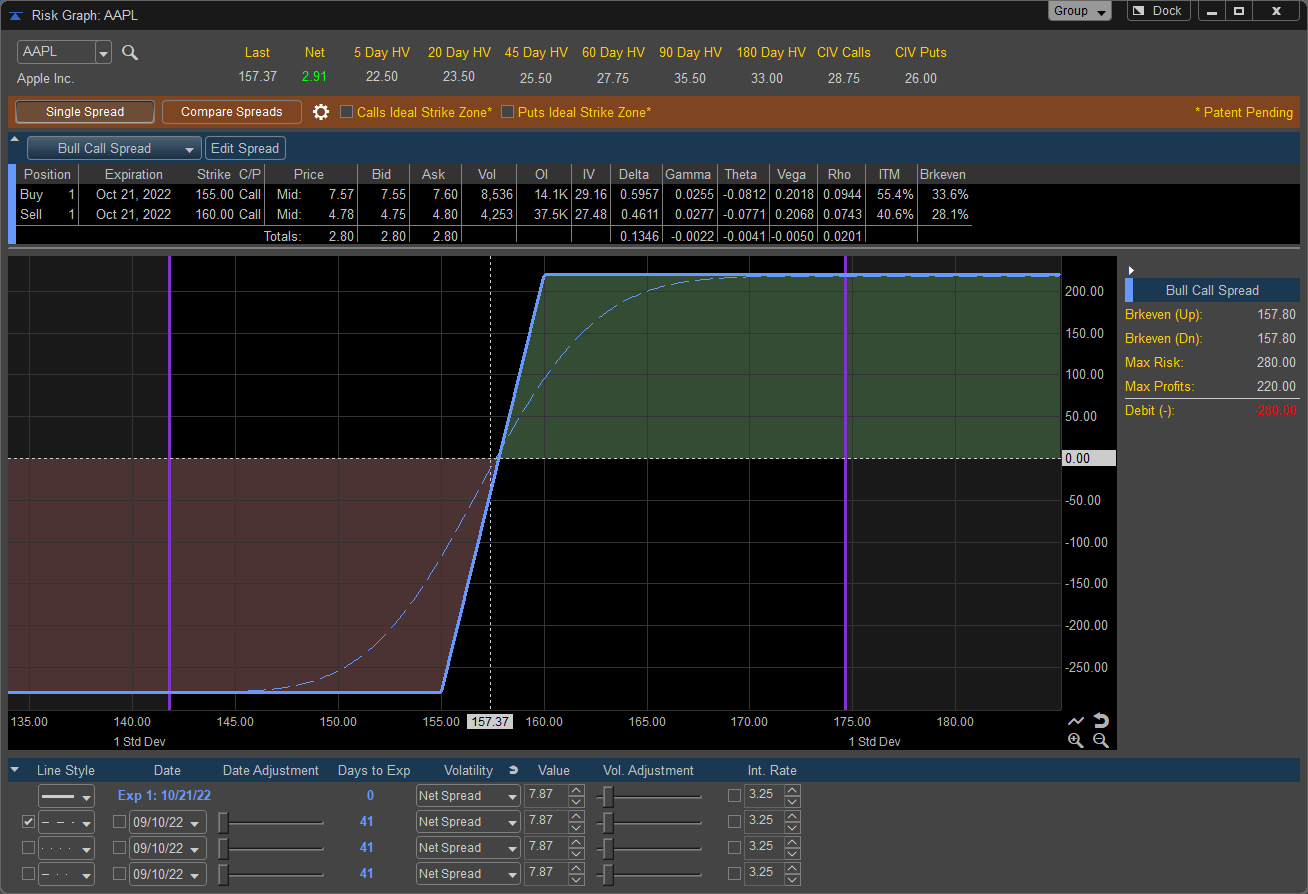

All NEW - Dynamic Trend Options Volume Map (Patented) and Strategy Builder

Identifying price targets using Options Open Interest Levels

Easily convert price targets to Options Strategies