Dynamic Trend Gamma

Monday July 31st - SPY

Dynamic Trend Gamma

Friday July 28th - $SPX

Dynamic Trend Gamma

Thursday July 27th - $SPX

Dynamic Trend Gamma

Wednesday July 26th - SPY

Dynamic Trend Gamma

Thursday July 20th - $SPX

The $SPX traded between the 2 Gamma Levels at 4540 and 4560.

The first Low at the 4540 Gamma Level was identified with the Options Sentiment switching to Call.

At the rally Top, the $SPX tested the 4560 Gamma Level and sold off, again with the Options Sentiment switching to Puts.

Dynamic Trend Gamma

Tuesday July 18th - SPY

Dynamic Trend Gamma

Friday July 14th - TSLA

TSLA made a major rally to the 285 Gamma Level. The early stages of the rally was identified with the Options Volume Sentiment switching to Calls.

After testing the 285 Gamma Level, it followed the market and sold off, again the Options Volume Sentiment identified the top with the Switch to Puts.

Dynamic Trend Gamma

Wednesday July 12th - $SPX

The $SPX gapped open and traded slightly above the Largest Gamma Level at 4475 and traded around that level for the rest of the day.

To be very honest, while some minor trades could have been identified with the Options Sentiment, overall, it did provide any significant help.

Dynamic Trend Gamma

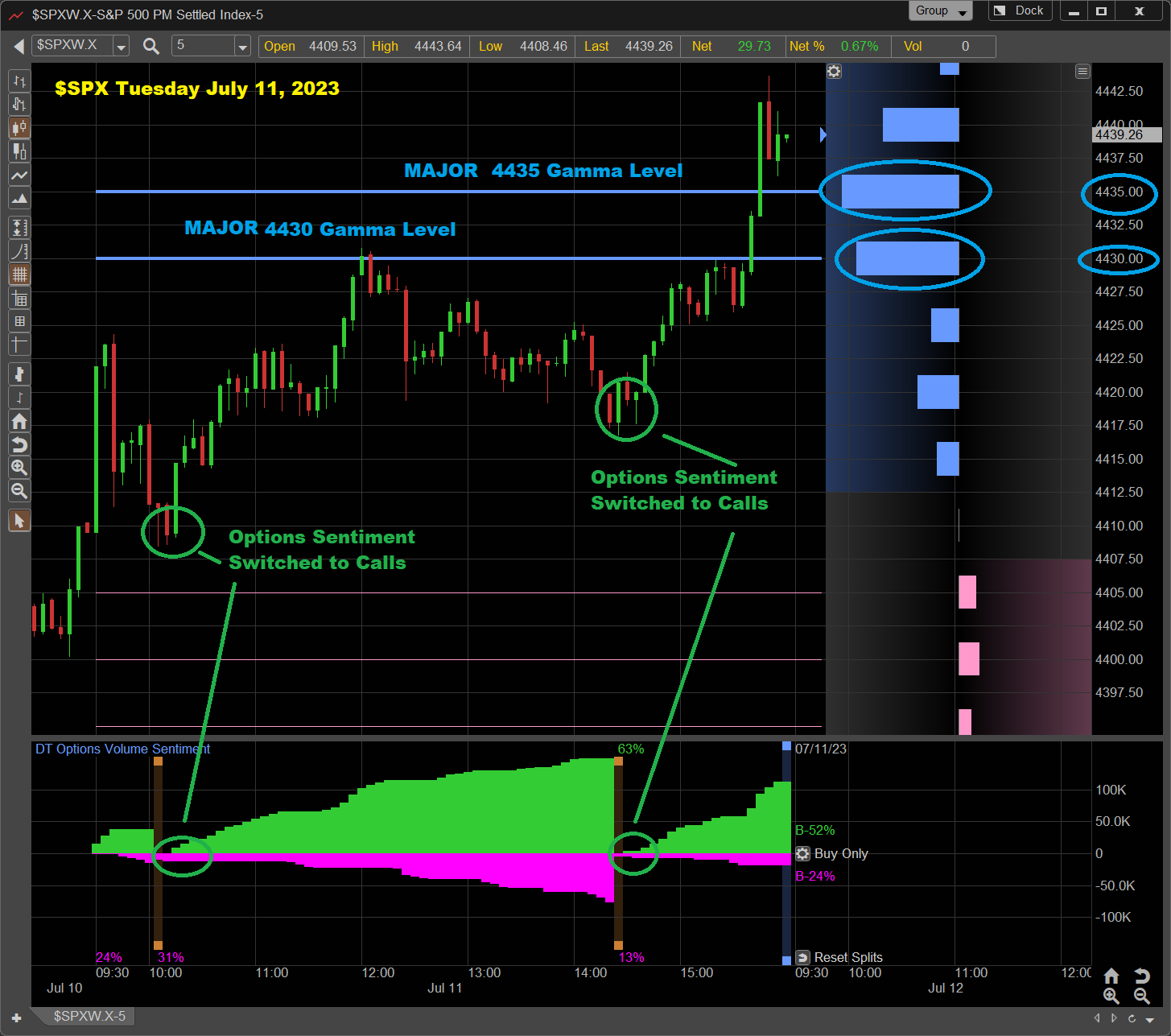

Friday July 7th - SPY

The SPY found support at the 439 Gamma Level.

From there it staged a rally confirmed by increasing Call Sentiment. Followed by a complete reversal with Increasing Put Sentiment.

In both cases, the Switch to Call Sentiment and the Switch to Put Sentiment identified the low and high. This is a powerful tool to use.

Dynamic Trend Gamma

Wednesday July 5th - $SPX

The $SPX Gapped lower, but managed to rally to Major 4450 Gamma Level.

Dynamic Trend Gamma

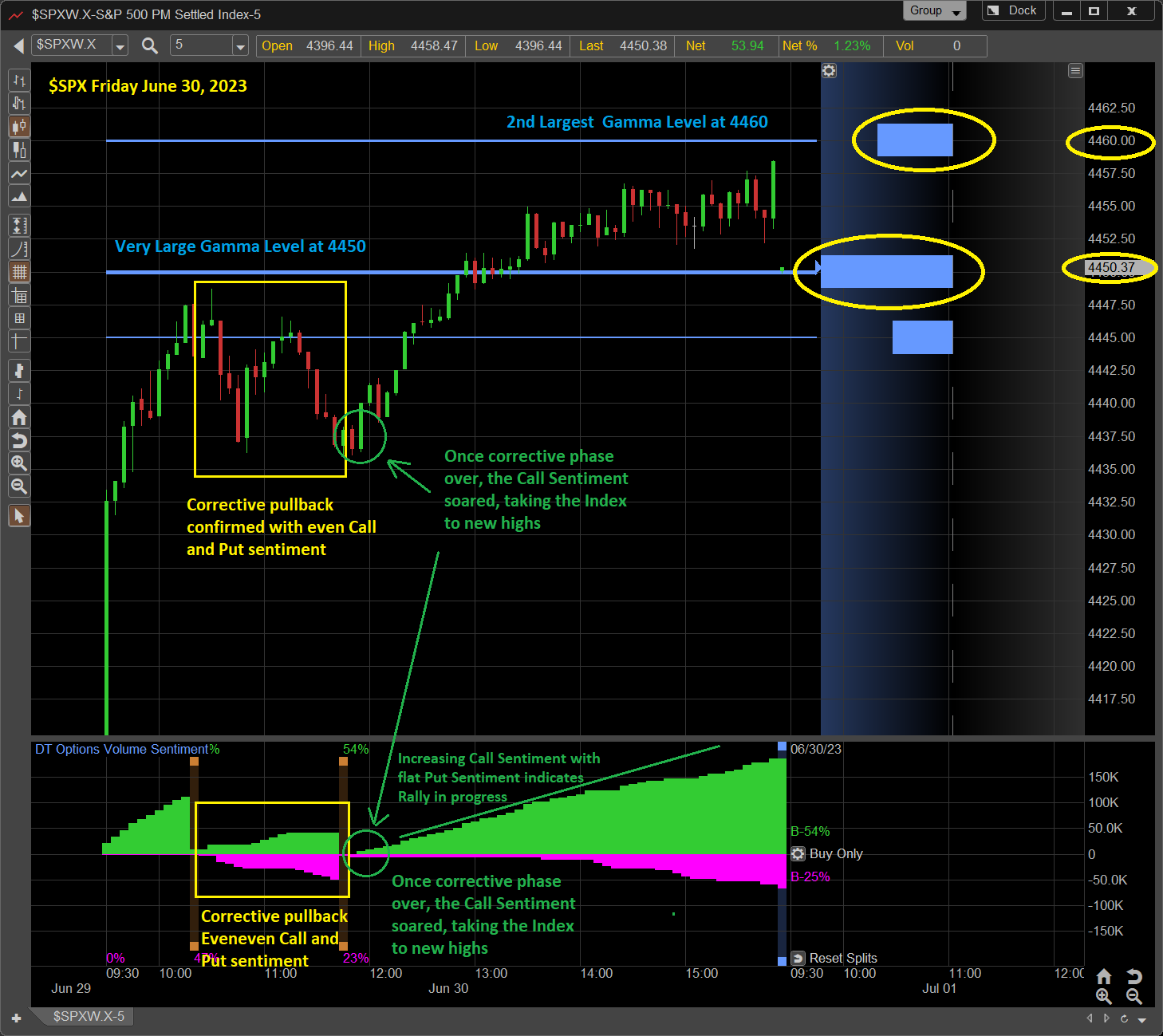

Friday June 30th - $SPX

The $SPX Gapped up and immediately traded up to the Very Large 4450 Gamma Level. Then went into a corrective mode, confirmed by even Call and Put Sentiment.

Once the corrective phase was over, the Call Sentiment soared indicating a strong rally in progress that took the $SPX towards the 2nd largest Gamma Level at 4460.

Dynamic Trend Gamma

Friday June 23rd - $SPX

The $SPX opened lower and found support near the 4350 Gamma Level. Then traded higher to the 4365 Gamma Level with increasing Call sentiment.

Right at the high, the Options Sentiment switched from Call side to Put side sentiment (marked with Pink Circles). Combining the Gamma Levels with the Options Volume sentiment gives an edge for 0DTE reversal trades.

Dynamic Trend Gamma

Friday June 16th - SPY

The SPY Index opened near the 443 Gamma Level and bounced between all the Major Gamma Levels today. In the middle of the day, after testing the 442 Gamma Level, the Put Sentiment took over and the SPY Index sold off to the Negative (Pink) Gamma Level at 439

Dynamic Trend Gamma

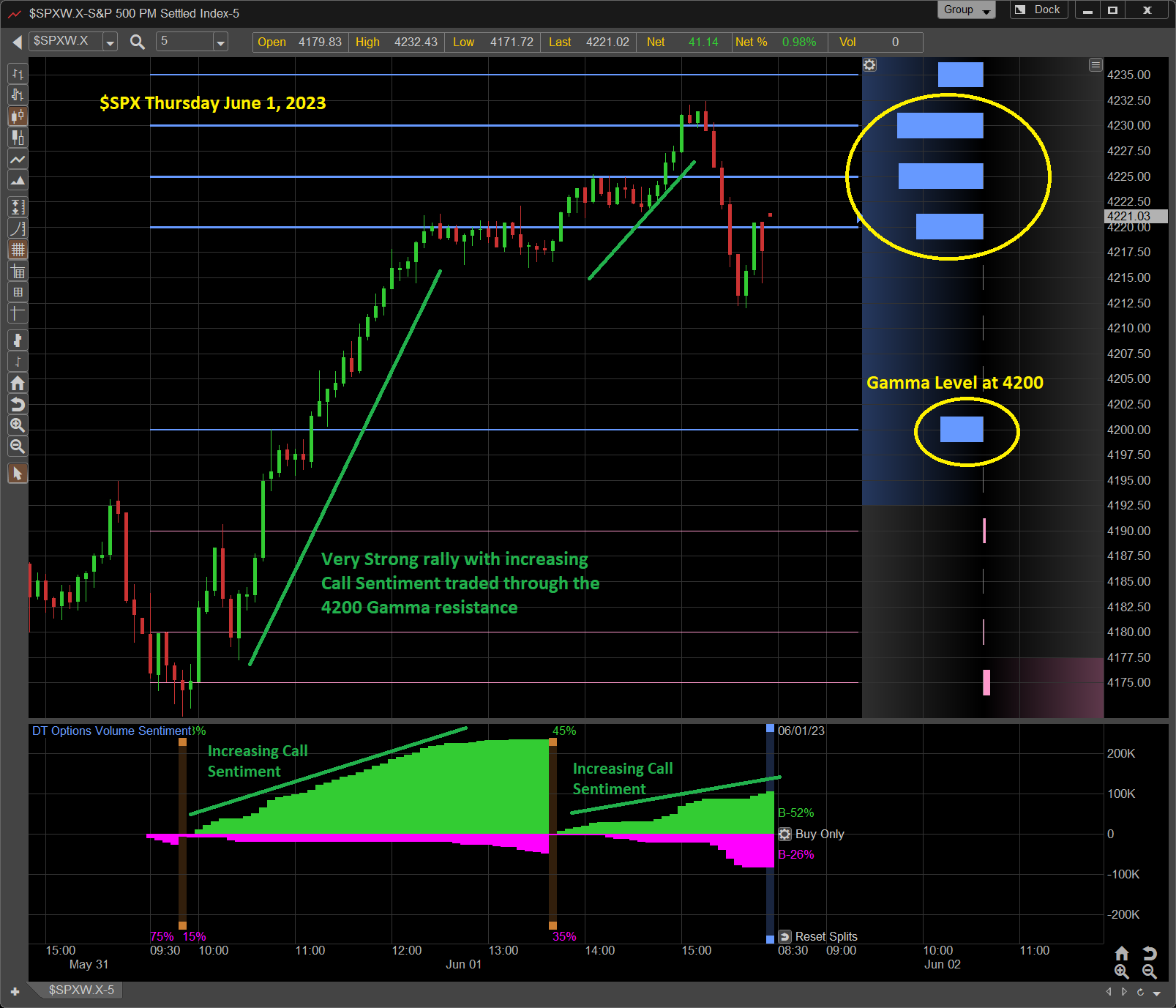

Wednesday May 17th - $SPX

The $SPX traded to the Large Gamma Cluster near the 4160 level in 2 individual rally phases, both confirmed with Increasing Call Sentiment. Hedging at Large Blue Gamma Levels results in attracting the underlying prices to the Large Gamma Levels. The Gamma Levels are identified at the open and updated throughout the day.

Dynamic Trend Gamma

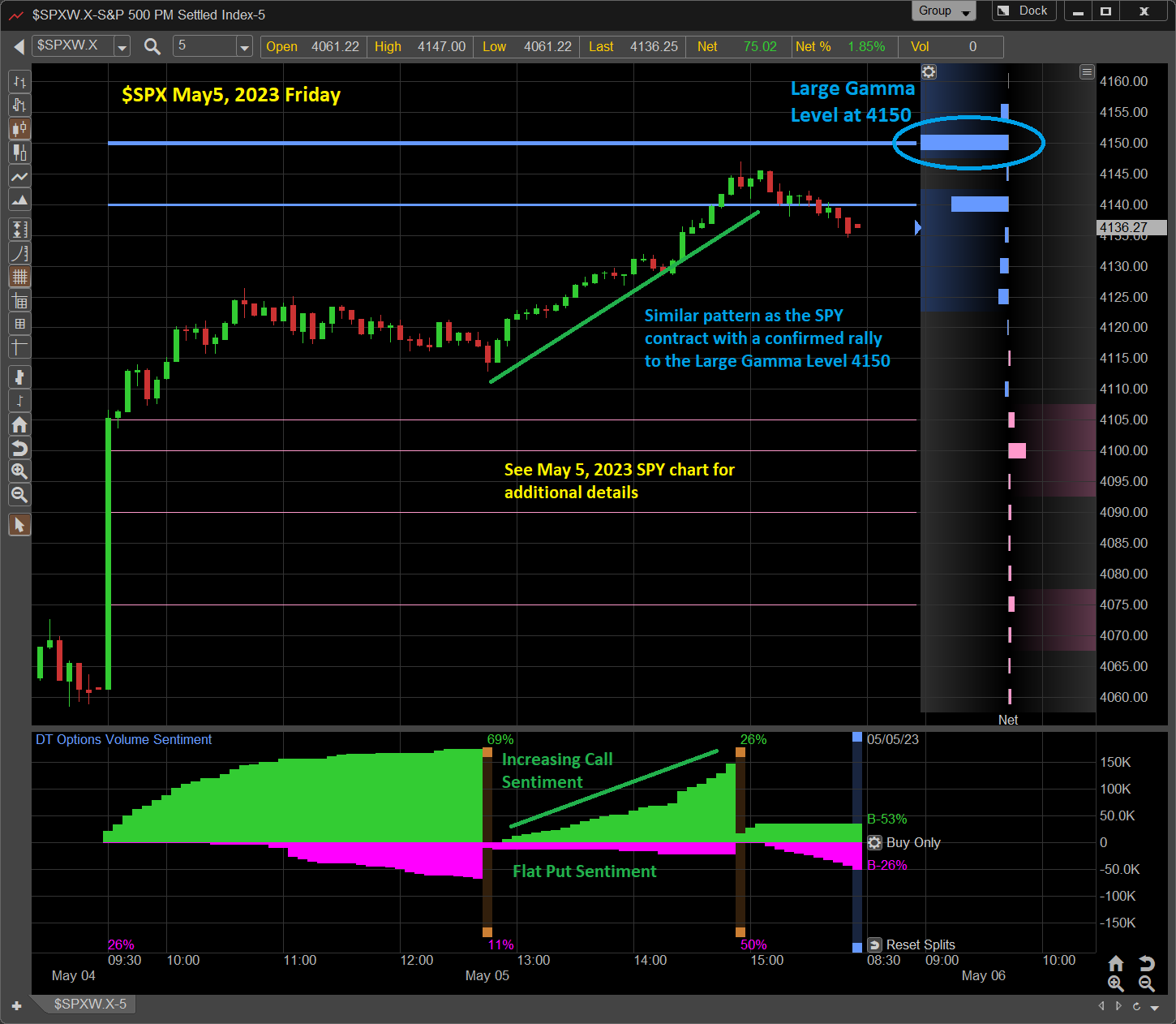

Friday May 12th - $SPX

These Gamma Resistance and Support levels are identified at the Open. The $SPX initially sold off from the 4140 Gamma Resistance Levels. Declined strongly to the major Gamma Support Level at 4100 with increasing Put Sentiment. Once the Major support at 4100 held a retest, the $SPX rallied to the close with increasing call Sentiment.

Dynamic Trend Gamma

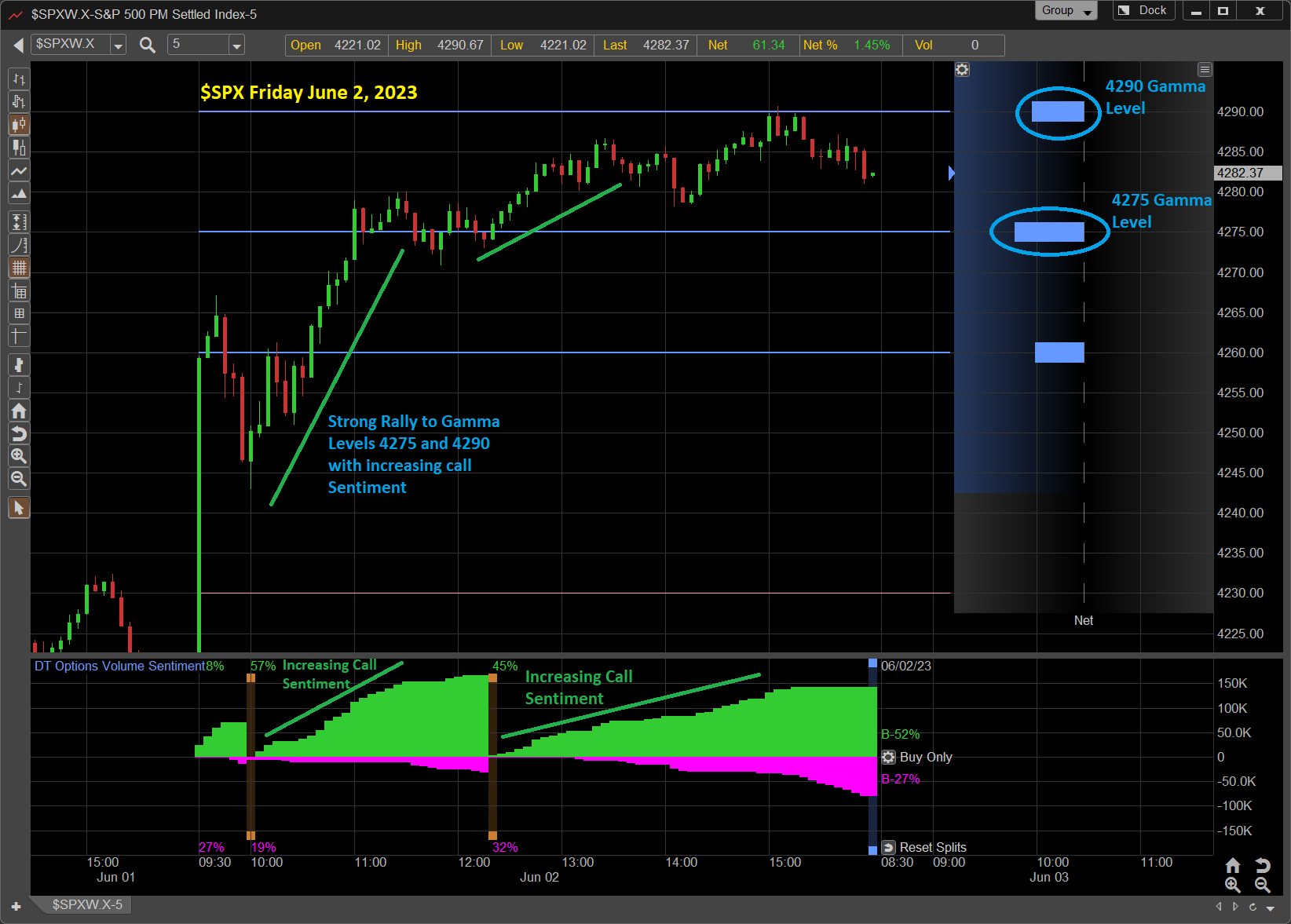

Friday May 5th - $SPX

The $SPX followed the same pattern as the SPY Index and rallied strong to the Large Gamma Level of 4150 with increasing Call Sentiment.

Dynamic Trend Gamma

Wednesday May 3rd - SPY

Prior to the Fed news, there was one clearly identified rally from the 410 Gamma Level, followed by a choppy session with no clear Call or Put Sentiment to help. The final sell off found support at the 408 Gamma Level with rising Put Sentiment in the last hour.