Dynamic Trend Gamma

Tuesday April 30th - $SPX

Dynamic Trend Gamma

Thursday April 25th - $SPX

Dynamic Trend Gamma

Wednesday April 24th - $SPY

Dynamic Trend Gamma

Monday April 22nd - $SPX

Dynamic Trend Gamma

Friday April 19th - $SPX

Dynamic Trend Gamma

Thursday April 18th - $SPX

Dynamic Trend Gamma

Wednesday April 17th - $SPY

Dynamic Trend Gamma

Monday April 15th - $SPX

Dynamic Trend Gamma

Monday April 15th - $SPY

Dynamic Trend Gamma

Friday April 12th - $SPY

Dynamic Trend Gamma

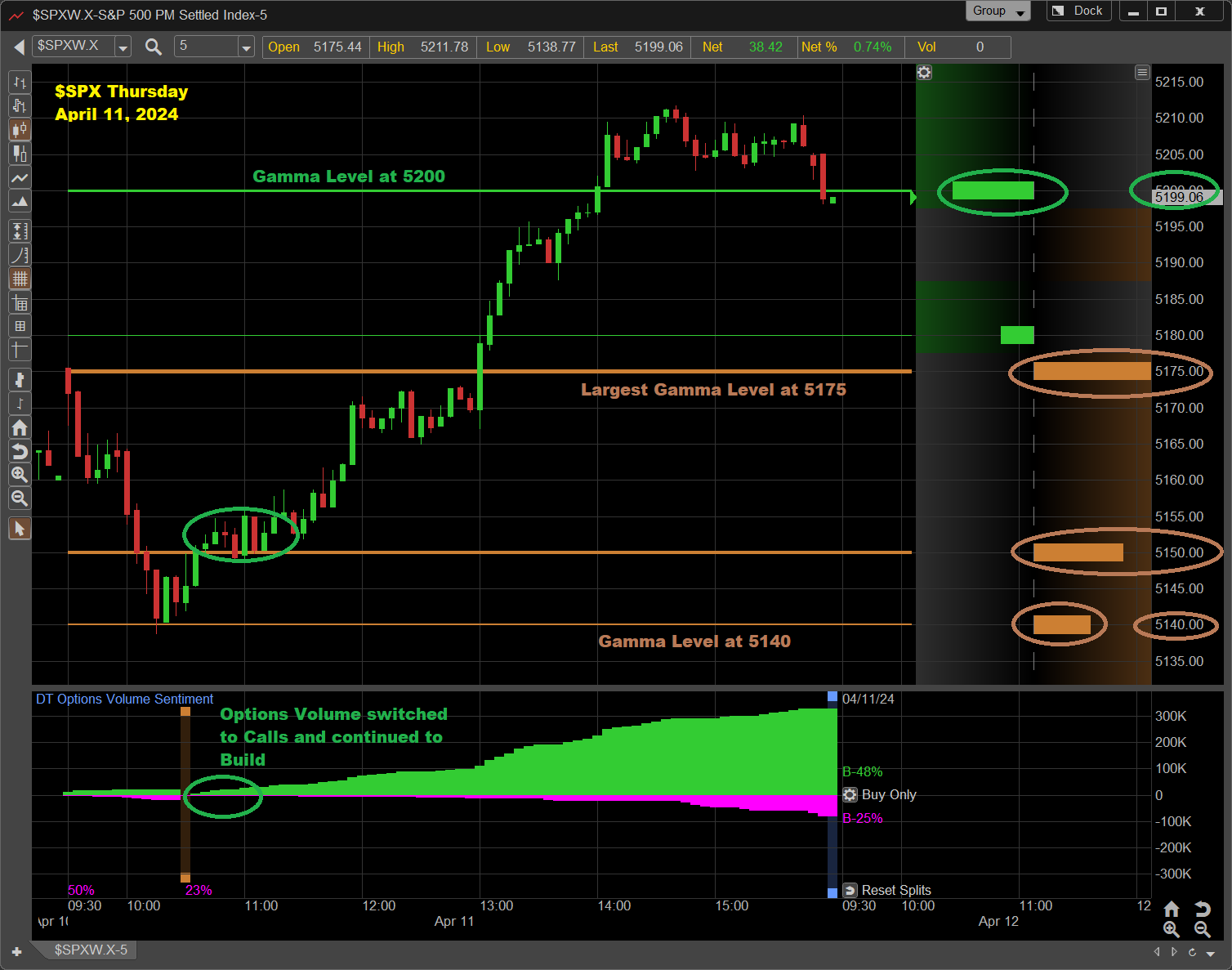

Thursday April 11th - $SPX

Dynamic Trend Gamma

Wednesday April 10th - $SPX

Dynamic Trend Gamma

Friday April 5th - $SPX

Dynamic Trend Gamma

Thursday April 4th - $SPY

Dynamic Trend Gamma

Wednesday April 3rd - $SPX

Dynamic Trend Gamma

Monday April 1st - $SPY

Dynamic Trend Gamma

Wednesday March 27th - $SPY

Dynamic Trend Gamma

Thursday March 21st - $SPX

Dynamic Trend Gamma

Wednesday March 20th - $SPY

Dynamic Trend Gamma

Friday March 8th - $SPX

Dynamic Trend Gamma

Wednesday March 6th - $SPY

Dynamic Trend Gamma

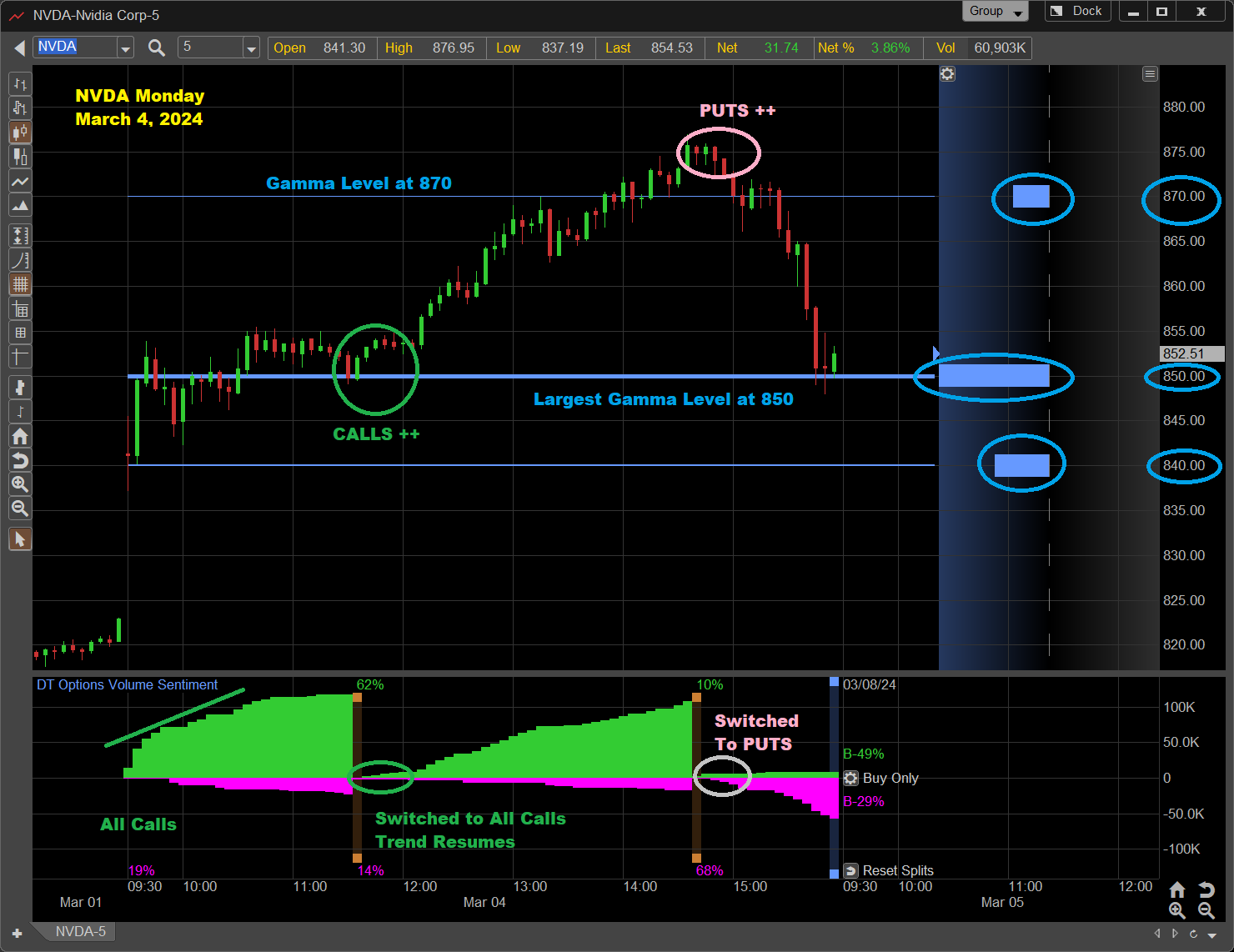

Monday March 4th - $NVDA

Dynamic Trend Gamma

Monday March 4th - $SPX

Dynamic Trend Gamma

Friday March 1st - $SPX

Dynamic Trend Gamma

Friday February 16th - $SPX

Dynamic Trend Gamma

Thursday February 15th - $SPX

Dynamic Trend Gamma

Wednesday February 14th - $SPX

Dynamic Trend Gamma

Tuesday February 13th - $SPX

Dynamic Trend Gamma

Monday February 12th - $SPX

Dynamic Trend Gamma

Friday February 9th - $SPX

Dynamic Trend Gamma

Tuesday February 6th - $SPY

Please note these Gamma Levels are calculated prior to the opening. The $SPX traded sideways all day between 2 Gamma Levels with Even Calls and Puts.

Dynamic Trend Gamma

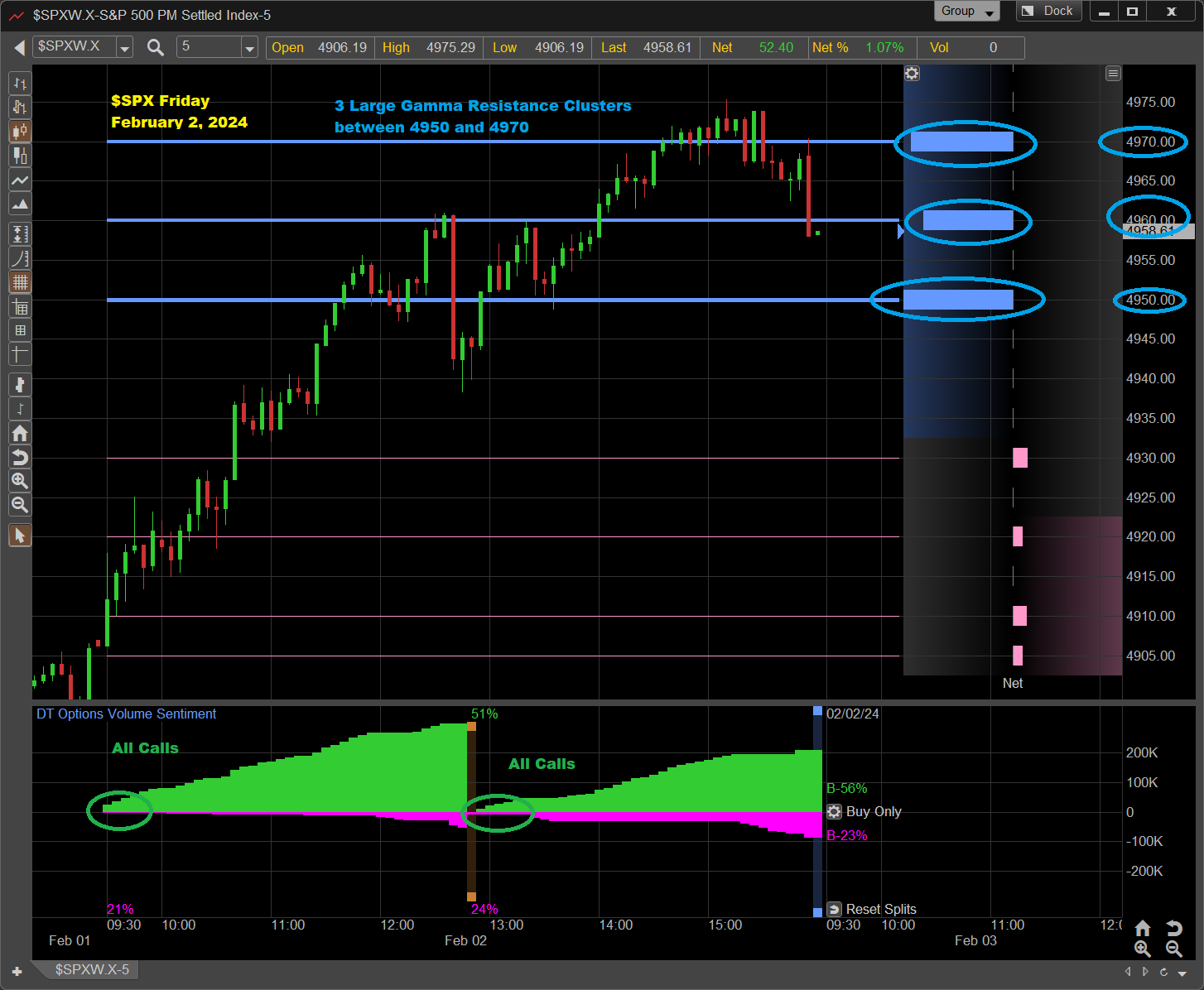

Thursday February 1st - $SPX