Dynamic Trend Gamma

Wednesday January 31st - $SPY

Dynamic Trend Gamma

Friday January 26th - $SPY

Dynamic Trend Gamma

Monday January 22nd - $SPX

Dynamic Trend Gamma

Thursday January 18th - $SPY

Dynamic Trend Gamma

Friday January 12th - $SPX

Dynamic Trend Gamma

Thursday January 11th - $SPX

Dynamic Trend Gamma

Wednesday January 10th - $SPY

Dynamic Trend Gamma

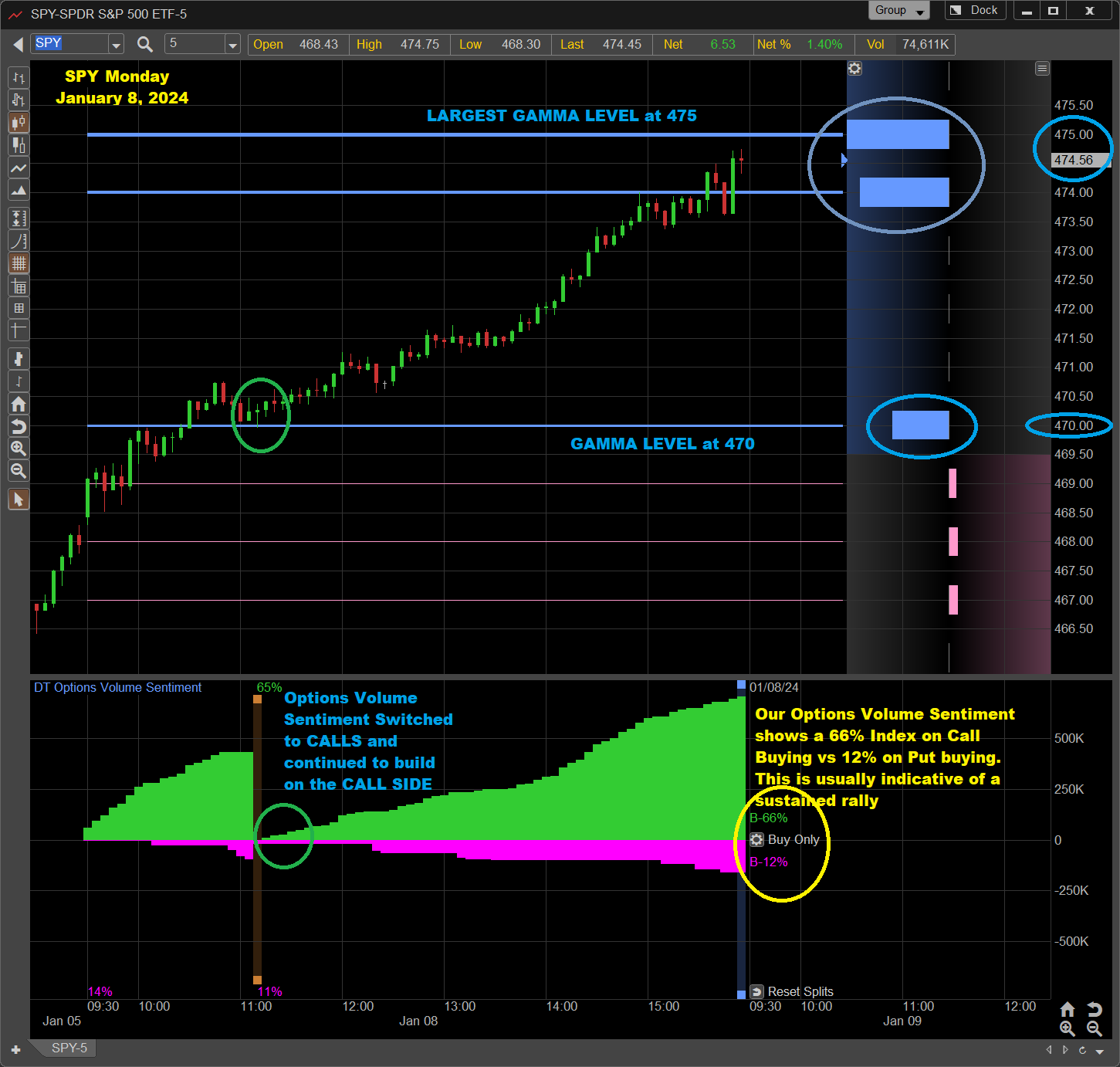

Monday January 8th - $SPY

Dynamic Trend Gamma

Wednesday January 3rd - $SPX

Dynamic Trend Gamma

Friday December 29th - SPY

Dynamic Trend Gamma

Thursday December 21st - $SPX

Dynamic Trend Gamma

Monday December 4th - $SPX

The $SPX traded between the main Gamma Levels at 4550 and 4575. The swings were clearly identified at their early stages with the Options Volume Sentiment. When the Sentiment = PUTS, expect a sell off. Likewise, when the Sentiment = CALLS, expect a rally.

Please note these swings have to originate at critical Gamma Levels such as the 4550 and 4575 Gamma Levels today.

Dynamic Trend Gamma

Tuesday November 28th - SPY

Dynamic Trend Gamma

Tuesday November 21st - $SPX

Dynamic Trend Gamma

Wednesday November 15th - $SPX

Dynamic Trend Gamma

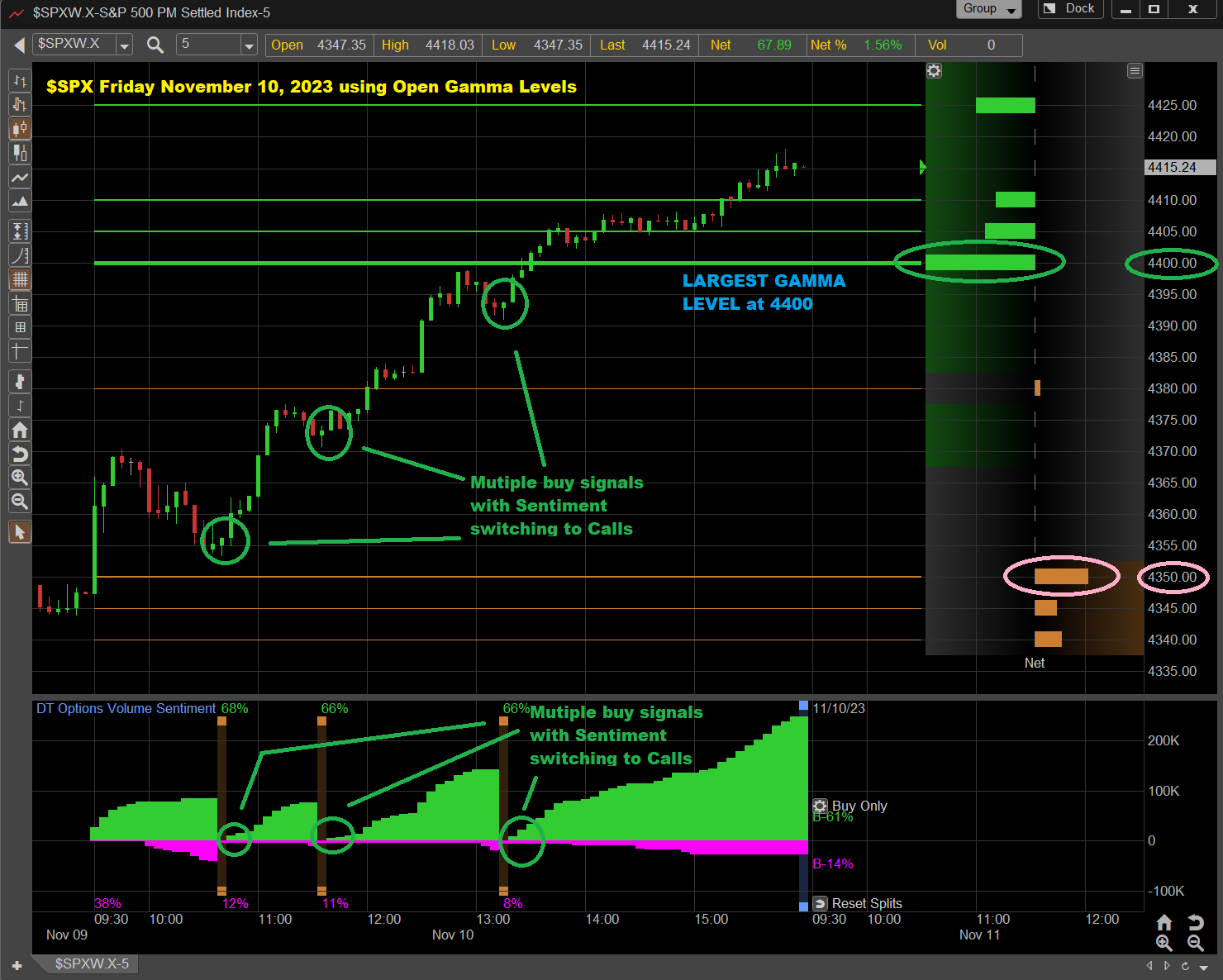

Friday November 10th - $SPX

Dynamic Trend Gamma

Thursday November 9th - $SPY

Dynamic Trend Gamma

Wednesday November 8th - $SPY

Dynamic Trend Gamma

Thursday November 2nd - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX gapped higher and traded to the largest Gamma level at 4300 with very strong Call Sentiment. After some sideways trading, the $SPX rallied again once the Sentiment switched to CALLS.

Dynamic Trend Gamma

Wednesday November 1st - $SPX

Dynamic Trend Gamma

Tuesday October 31st - $SPX

Dynamic Trend Gamma

Friday October 27th - $SPX

Dynamic Trend Gamma

Thursday October 26th - $SPX

Dynamic Trend Gamma

Wednesday October 25th - $SPX

Dynamic Trend Gamma

Tuesday October 24th - $SPX

Dynamic Trend Gamma

Thursday October 19th - $SPX

Dynamic Trend Gamma

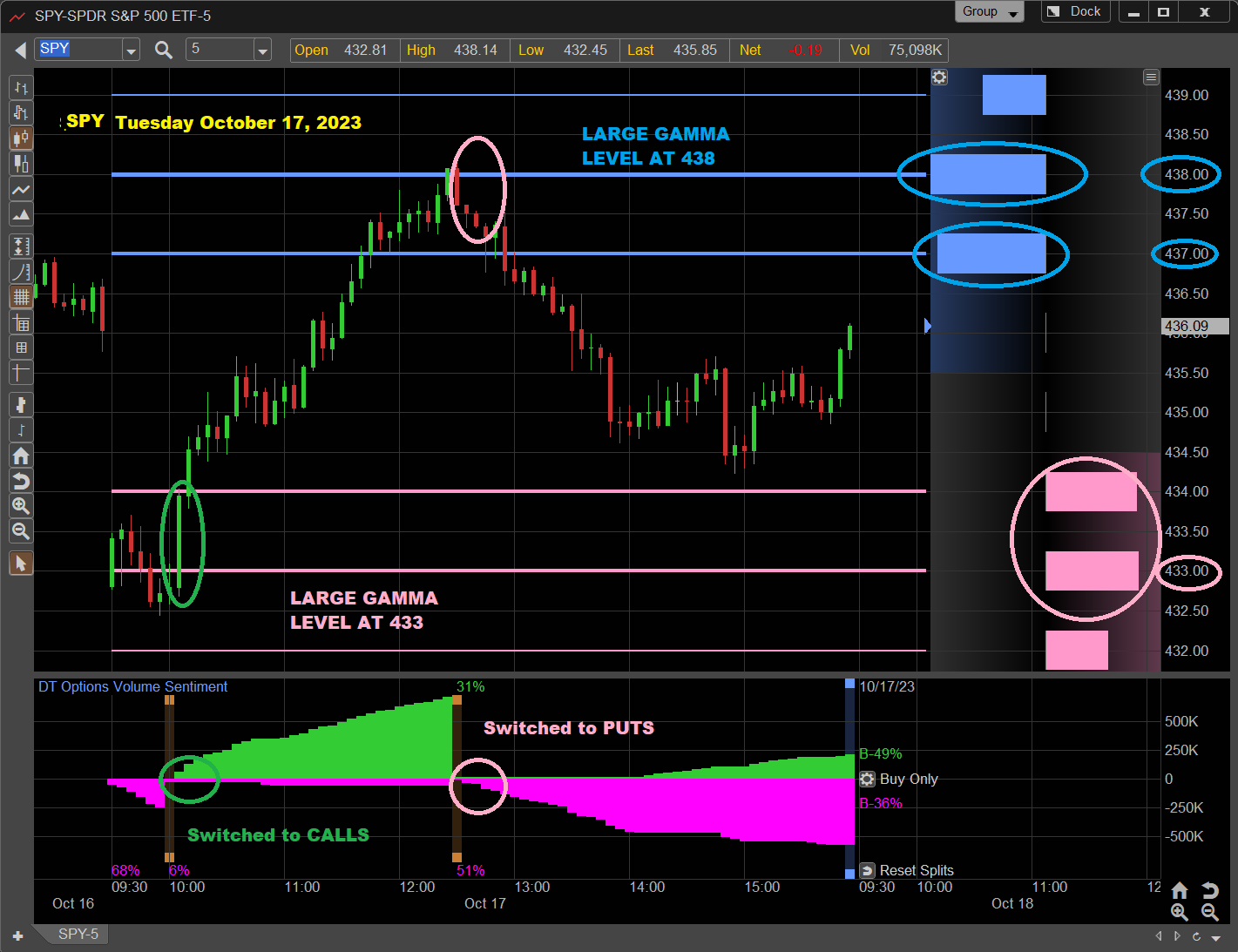

Tuesday October 17th - $SPY

Dynamic Trend Gamma

Monday October 16th - $SPY

Dynamic Trend Gamma

Thursday October 12th - $SPX

Dynamic Trend Gamma

Wednesday October 11th - $SPY

Dynamic Trend Gamma

Monday October 9th - SPY

Dynamic Trend Gamma

Friday October 6th - SPY

Please note these Gamma Levels are calculated prior to the opening.

The SPY Traded lower to the Large Open Gamma Cluster at 420, found support at 420.60 just shy of the 420 Gamma Level. From there the SPY rallied past the next Large Gamma cluster at 424 and headed to the 430 Gamma Level.

Both the initial rally and the rally following the pullback was identified by the Options Sentiment switching to CALLS.

Dynamic Trend Gamma

Wednesday October 4th - SPY

Dynamic Trend Gamma

Monday October 2nd - SPY

Please note these Gamma Levels are calculated prior to the opening.

SPY opened near the 428 Gamma Level and around 11:30 Eastern the Options Volume Sentiment changed heavily to PUTS. This SPY sold off sharply to the Largest Gamma Level at 425, where it found support.

Dynamic Trend Gamma

Friday September 29th - $SPX

Dynamic Trend Gamma

Thursday September 28th - SPY

Dynamic Trend Gamma

Wednesday September 27th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

$SPX Gapped lower and traded lower to the 4240 and 4250 Gamma Levels. From the Gamma Lows, the $SPX rallied sharply.

At the early stages of this rally, notice the Options Sentiment switching to CALLS, giving an advance warning to the rally.

Dynamic Trend Gamma

Monday September 25th - SPY

Dynamic Trend Gamma

Thursday September 21st - SPY

Dynamic Trend Gamma

Wednesday September 20th - SPY

Dynamic Trend Gamma

Tuesday September 19th - SPY

Dynamic Trend Gamma

Monday September 18th - SPY

Dynamic Trend Gamma

Friday September 15th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX opened down sharply and the 4450 Gamma Level being the Largest Level, the 4450 was the target for the decline.

After a small counter trend rally, the $SPX raced down to the 4450 Gamma Level. The Options Volume Sentiment confirmed the sharp sell off by switching to PUT Sentiment.

Dynamic Trend Gamma

Thursday September 14th - SPY

Dynamic Trend Gamma

Wednesday September 13th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX initially found support at the 4455 Major Gamma Level and rallied sharply to the 4480 Gamma Level. The early stages of this rally were clearly identified with the Options Sentiment switching to Calls.

Then the $SPX sold off to the lower Gamma level at 4455, again the sell off was clearly identified with the Options Sentiment switching to Puts.

Dynamic Trend Gamma

Tuesday September 12th - SPY

Dynamic Trend Gamma

Monday September 11th - SPY

Dynamic Trend Gamma

Monday September 11th - SPY

Dynamic Trend Gamma

Friday September 8th - $SPX

Dynamic Trend Gamma

Wednesday September 6th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX immediately set its path lower to the LARGEST GAMMA LEVEL at 4450. The Options volume Sentiment also switched to Puts and with increasing Put Sentiment, the $SPX traded one level lower to the 2nd Largest Gamma Level at 4445.

Soon thereafter, the Options Volume Sentiment switched to Calls indicating a rally potential. The $SPX traded up towards the 4470 Gamma Level.

Dynamic Trend Gamma

Tuesday September 5th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX rallied to the 4515 Gamma Level, where the Put Sentiment took over and the $SPX sold off to the lower Large Gamma Level at 4500.

After a brief rally to the 4510 gamma level, the $SPX settled at the Large Gamma Level at 4500

Dynamic Trend Gamma

Friday September 1st - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX rallied to the 4540 Major Gamma Level, where the Put Sentiment took over and the $SPX sold off to the lower Gamma Level at 4500.

The combination of the Gamma Levels and the Options Volume Sentiment provides a great advantage to trade the Zero DTE options.

Dynamic Trend Gamma

Thursday August 31st - SPY

Please note these Gamma Levels are calculated prior to the opening.

The SPY rallied very close to Gamma Resistance Level at 453 and immediately the Options Volume Sentiment switched to Puts followed by a sell off.

The SPY continued to trade between Gamma Levels for small swings for the rest of the day.

Dynamic Trend Gamma

Tuesday August 29th - $SPX

Dynamic Trend Gamma

Monday August 28th - SPY

Dynamic Trend Gamma

Friday August 25th - $SPX

Please note these Gamma Levels are calculated prior to the opening. The $SPX sold off quickly to the Largest Gamma Support Level at 4360.

From there it managed to rally towards the Gamma Resistance Level at 4425. Options Volume Sentiment provided "Switch to Calls" indication at critical areas.

Dynamic Trend Gamma

Thursday August 24th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

By 10 am Eastern the Options Volume Sentiment switched to Puts, meaning we detected huge Put Buying vs Calls.

The $SPX sold off sharply. After a brief rally attempt to the Minor Gamma levels at 4415, the Options Volume Sentiment again switched to Puts, bringing the market down to the Very Substantial Gamma Level at 4380.

We have daily examples from April showing how the combination of our pre-calculated Gamma Levels and Real Options Volume Sentiment can help navigate 0DTE trading.

Dynamic Trend Gamma

Thursday August 24th - QQQ

Please note these Gamma Levels are calculated prior to the opening.

Like the $SPX, Options Volume Sentiment switched in the $QQQ to Puts right at the opening, meaning we detected huge Put Buying vs Calls.

The $QQQ sold off sharply. After a brief rally attempt to the Gamma levels at 365, the Options Volume Sentiment again switched to Puts, bringing the $QQQ down near the Very Substantial Gamma Level at 360. (Please note for our users, we are using the Opening Gamma Levels here).

Dynamic Trend Gamma

Wednesday August 23rd - $SPX

The $SPX traded quickly to the 4430 Gamma Level and after a small sideways trading, it attempted to rally to the 4450 Gamma Level.

Both the initial rally and the follow up rally clearly showed Options Volume Sentiment switch to CALLS and continued Call strength throughout.

Dynamic Trend Gamma

Tuesday August 22nd - $SPX

Dynamic Trend Gamma

Monday August 21st - $SPX

Dynamic Trend Gamma

Thursday August 17th - $SPX

Dynamic Trend Gamma

Wednesday August 16th - $SPX

Please note these Gamma Levels are calculated prior to the opening. The $SPX traded right to the 4450 Gamma Level and after several rally attempts, the market sold off as identified by the Switch to Puts in the Options Sentiment.

Then after a brief counter trend rally, the Options Sentiment once again switched to Puts at 14:30 Est and the $SPX gravitated to the Large Gamma Support level at 4400.

Dynamic Trend Gamma

Tuesday August 15th - SPY

SPY gapped lower and immediately tested the 444 Large Gamma Level. After a brief rally, the SPY traded lower to the 443 Gamma Level. On all the sell offs, the Options Volume sentiment switched to Puts.

Dynamic Trend Gamma

Friday August 11th - $SPX

Dynamic Trend Gamma

Wednesday August 9th - $SPX

Please note these Gamma Levels are calculated prior to the opening. The SPY gapped lower and sold off sharply but found support at the Major Gamma Support Level at 4465.

From there it staged a rally to test the opening highs, with Options Volume Sentiment showing a switch to Call Sentiment. Then at the highs, the Sentiment switched back to Puts.

Dynamic Trend Gamma

Tuesday August 8th - SPY

Please note these Gamma Levels are calculated prior to the opening.

The SPY gapped lower and finally found support at the 445 Gamma Level. Around 11 am Eastern, the Options Volume sentiment switched from bearish Puts to Calls. From there the SPY Rallied to the Largest Gamma Level at 449.

The combination of the pre-calculated Gamma Levels (Support/Resistance) and the dynamic Options Volume Sentiment (direction) provides great trading opportunities in these Zero DTE expirations.

Dynamic Trend Gamma

Monday August 7th - $SPX

Please note these Gamma Levels are calculated prior to the opening. The $SPX found support at the Very Strong Gamma Support at 4490.

Unfortunately, no further Gamma Levels were identified. In such cases, the Speed Bumps generate targets and resistance levels when applied from the previous pivot.

Dynamic Trend Gamma

Friday August 4th - SPY

Please note these Gamma Levels are calculated prior to the opening. A picture paints a thousand words. The Gamma Levels identified all the major Highs (453) and Lows (449 and 447) for today.

The Options Volume Sentiment identified the morning Low and the final High for the day by Switching the Sentiment direction.

Dynamic Trend Gamma

Thursday August 3rd - $SPX

Please note these Gamma Levels are calculated prior to the opening. After the initial Gap Down, the $SPX found support at 4490 (A Major Gamma Support Level).

The Options Volume Sentiment switched to Call Sentiment, indicating the beginning of the rally. Unfortunately, there were no Gamma Resistance levels detected near the top of the rally.

The only indication of a top was the Switch in Options Volume Sentiment to Puts around 13:30 pm Eastern

Dynamic Trend Gamma

Wednesday August 2nd - SPY

Please note these Gamma Levels are calculated prior to the opening. With the Fitch downgrade, the SPY sold off sharply.

It found initial support at the Major Gamma level at 450. Then around 1:30pm Est after a small rally, the Options switched Sentiment to the Put side setting up another sell off to new lows.