To view previous archived examples, click here: May 2024 - August 2024

To view previous archived examples, click here: February 2024 - April 2024

To view previous archived examples, click here: August 2023 - January 2024

To view previous archived examples, click here: April 2023 - July 2023

Dynamic Trend Gamma

Wednesday April 23rd - $SPX

Dynamic Trend Gamma

Monday April 21st - $SPX

Dynamic Trend Gamma

Thursday April 17th - $SPX

Dynamic Trend Gamma

Wednesday April 16th - $SPY

Dynamic Trend Gamma

Friday April 11th - $SPY

Dynamic Trend Gamma

Thursday April 10th - $SPY

Dynamic Trend Gamma

Wednesday April 9th - $AMZN

Dynamic Trend Gamma

Wednesday April 9th - $AMZN

Dynamic Trend Gamma

Wednesday April 9th - $MSFT

Dynamic Trend Gamma

Wednesday April 9th - $TSLA

Dynamic Trend Gamma

Wednesday April 9th - $NFLX

Dynamic Trend Gamma

Tuesday April 8th - $SPY

Dynamic Trend Gamma

Friday April 4th - $SPX

Dynamic Trend Gamma

Thursday April 3rd - $SPX

Dynamic Trend Gamma

Wednesday April 2nd - $SPX

Dynamic Trend Gamma

Tuesday April 1st - $SPX

Dynamic Trend Gamma

Monday March 31st - $SPX

Dynamic Trend Gamma

Friday March 28th - $SPY

Dynamic Trend Gamma

Thursday March 27th - $SPX

Dynamic Trend Gamma

Wednesday March 26th - $SPX

Dynamic Trend Gamma

Monday March 24th - $SPX

Dynamic Trend Gamma

Friday March 21st - $SPX

Dynamic Trend Gamma

Thursday March 20th - $SPX

Dynamic Trend Gamma

Wednesday March 19th - $NFLX

Dynamic Trend Gamma

Wednesday March 19th - $SPY

Dynamic Trend Gamma

Tuesday March 18th - $SPX

Dynamic Trend Gamma

Monday March 17th - $SPX

Dynamic Trend Gamma

Friday March 14th - $SPX

Dynamic Trend Gamma

Thursday March 13th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX traded to a small Gamma Level at 5600, but the Options Volume sentiment changed to PUTS

With the sentiment in PUTS increasing, the $SPX traded lower to test the LARGEST GAMMA Level at 5500.

In between getting to lows, all the rally attempts failed at the 2nd Largest Gamma Level at 5550.

Identifying the LARGEST GAMMA Level is critical, as the markets tend to test it frequently.

Dynamic Trend Gamma

Wednesday March 12th - $SPX

Dynamic Trend Gamma

Tuesday March 11th - $SPX

Dynamic Trend Gamma

Monday March 10th - $SPY

Dynamic Trend Gamma

Friday March 7th - $SPX

Dynamic Trend Gamma

Thursday March 6th - $SPY

Dynamic Trend Gamma

Wednesday March 5th - $SPX

Dynamic Trend Gamma

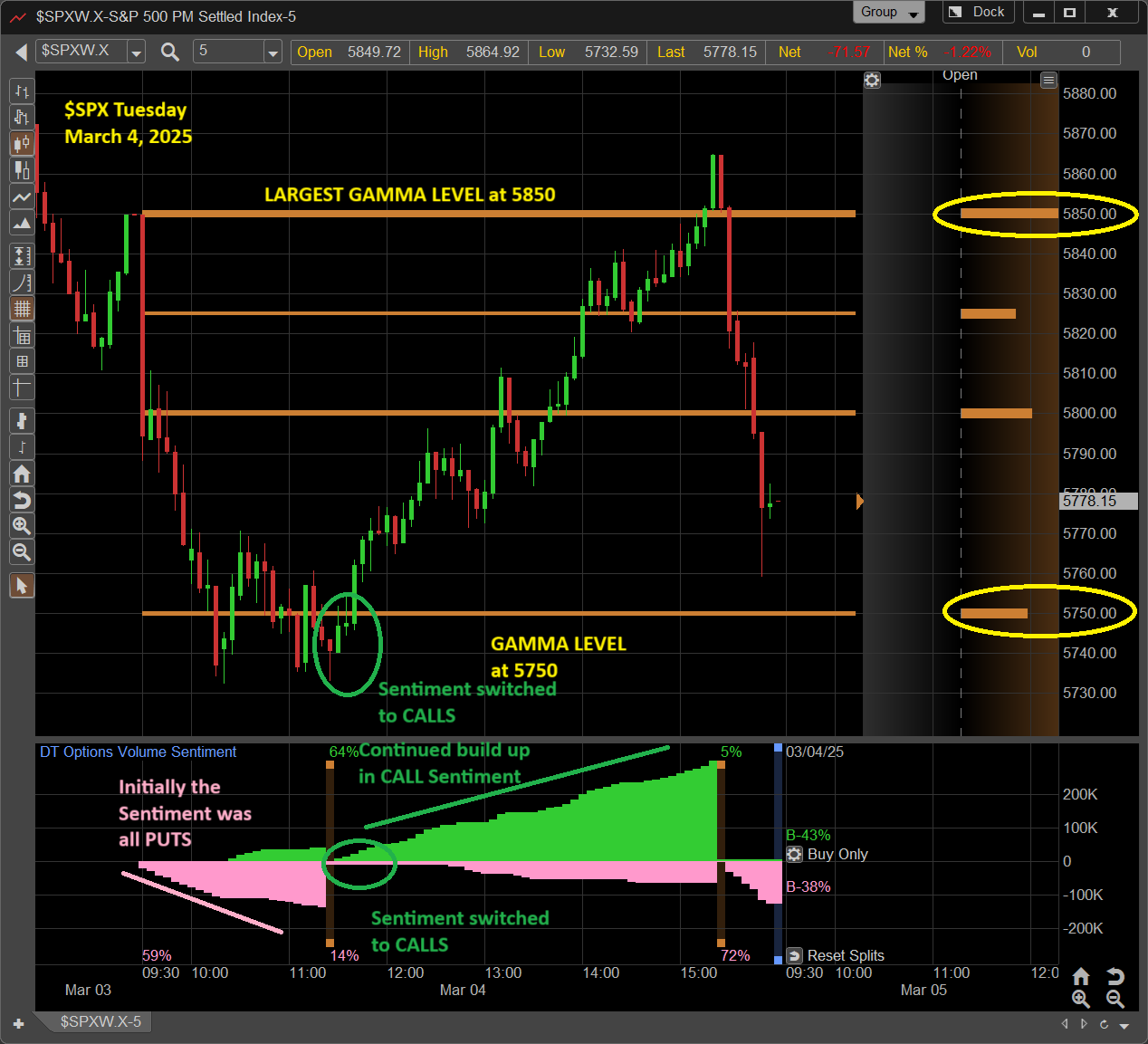

Tuesday March 4th - $SPX

Dynamic Trend Gamma

Monday March 3rd - $SPY

Dynamic Trend Gamma

Monday March 3rd - TSLA

Dynamic Trend Gamma

Friday February 28th - $SPX

Dynamic Trend Gamma

Thursday February 27th - $SPX

Dynamic Trend Gamma

Wednesday February 26th - $SPX

Dynamic Trend Gamma

Tuesday February 25th - $SPY

Dynamic Trend Gamma

Monday February 24th - $SPX

Dynamic Trend Gamma

Friday February 21st - $SPX

Dynamic Trend Gamma

Friday February 21st - NFLX

Dynamic Trend Gamma

Thursday February 20th - $SPX

Dynamic Trend Gamma

Wednesday February 19th - $SPX

Dynamic Trend Gamma

Tuesday February 18th - $SPX

Dynamic Trend Gamma

Thursday February 13th - $SPX

Please note these Gamma Levels are calculated prior to the opening.

The $SPX opened higher and there was a quick and constant build up in Call Sentiment.

This enabled the $SPX to rally to the 2nd Largest Gamma Level at 6090.

After a brief pullback, the Options Volume Sentiment switched to CALLS again.

This enabled the $SPX to start a new rally to the Largest Gamma Level.

Dynamic Trend Gamma

Wednesday February 12th - $SPY

Dynamic Trend Gamma

Monday February 3rd - $SPX

Dynamic Trend Gamma

Friday January 31st - $SPX

Dynamic Trend Gamma

Wednesday January 29th - $SPY

Dynamic Trend Gamma

Tuesday January 28th - $SPY

Dynamic Trend Gamma

Friday January 24th - $SPY

Dynamic Trend Gamma

Thursday January 23rd - $SPY

Dynamic Trend Gamma

Wednesday January 22nd - $SPX

Dynamic Trend Gamma

Tuesday January 21st - $SPX

Dynamic Trend Gamma

Wednesday January 15th - $SPY

Dynamic Trend Gamma

Monday January 13th - $SPX

Dynamic Trend Gamma

Friday January 10th - $SPY

Dynamic Trend Gamma

Wednesday January 8th - $SPY

Dynamic Trend Gamma

Tuesday January 7th - $SPY

Dynamic Trend Gamma

Monday January 6th - $SPX

Dynamic Trend Gamma

Friday January 3rd - $SPX

Dynamic Trend Gamma

Thursday December 26th - $SPX

Dynamic Trend Gamma

Friday November 8th - $SPX

Dynamic Trend Gamma

Wednesday November 6th - $SPX

Dynamic Trend Gamma

Thursday October 31st - $SPX

Dynamic Trend Gamma

Friday October 25th - $SPX

Dynamic Trend Gamma

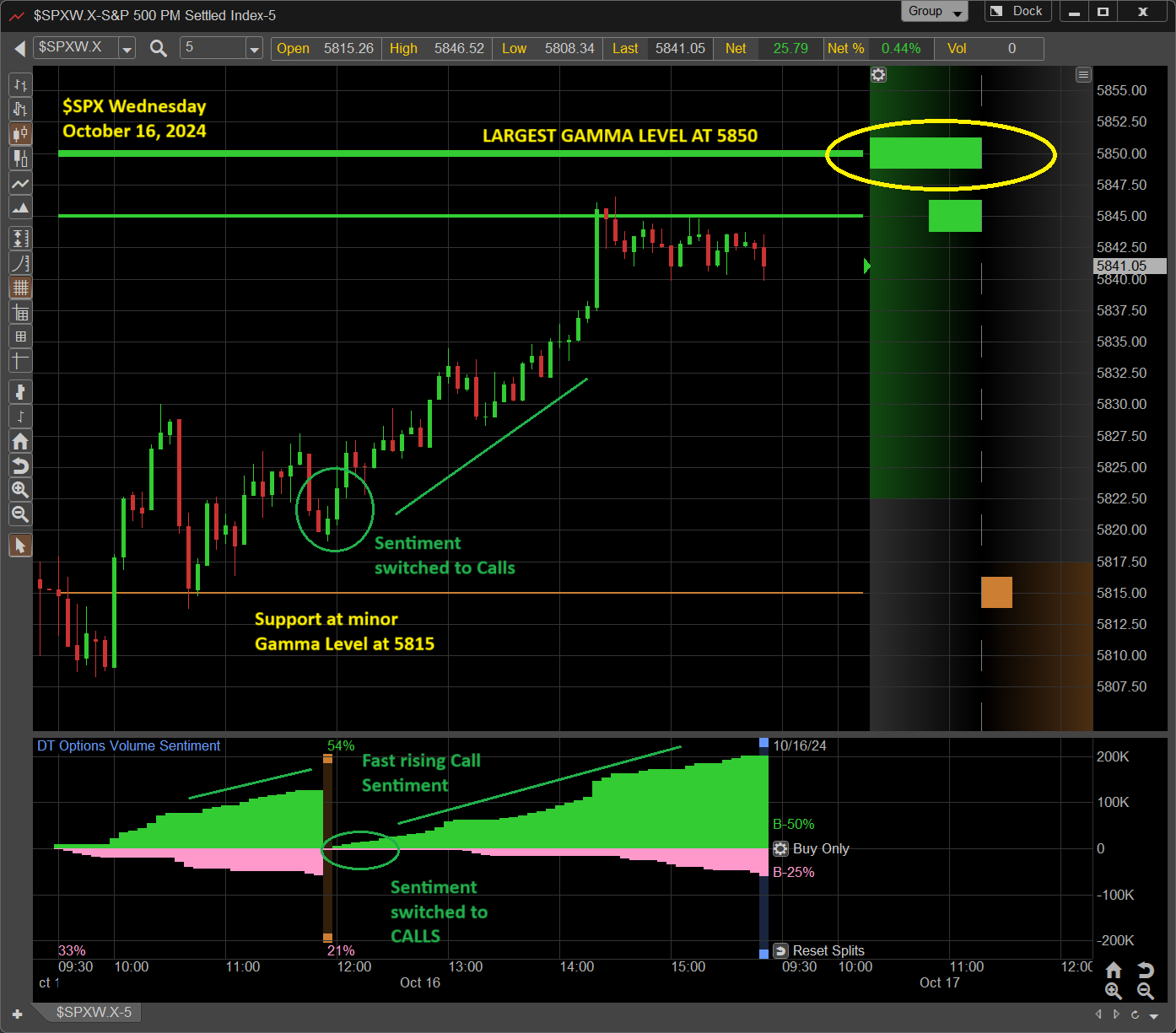

Wednesday October 16th - $SPX

Dynamic Trend Gamma

Tuesday October 15th - $SPX

Dynamic Trend Gamma

Monday October 14th - $SPY

Dynamic Trend Gamma

Friday October 11th - $SPX

Dynamic Trend Gamma

Wednesday October 9th - $SPX

Dynamic Trend Gamma

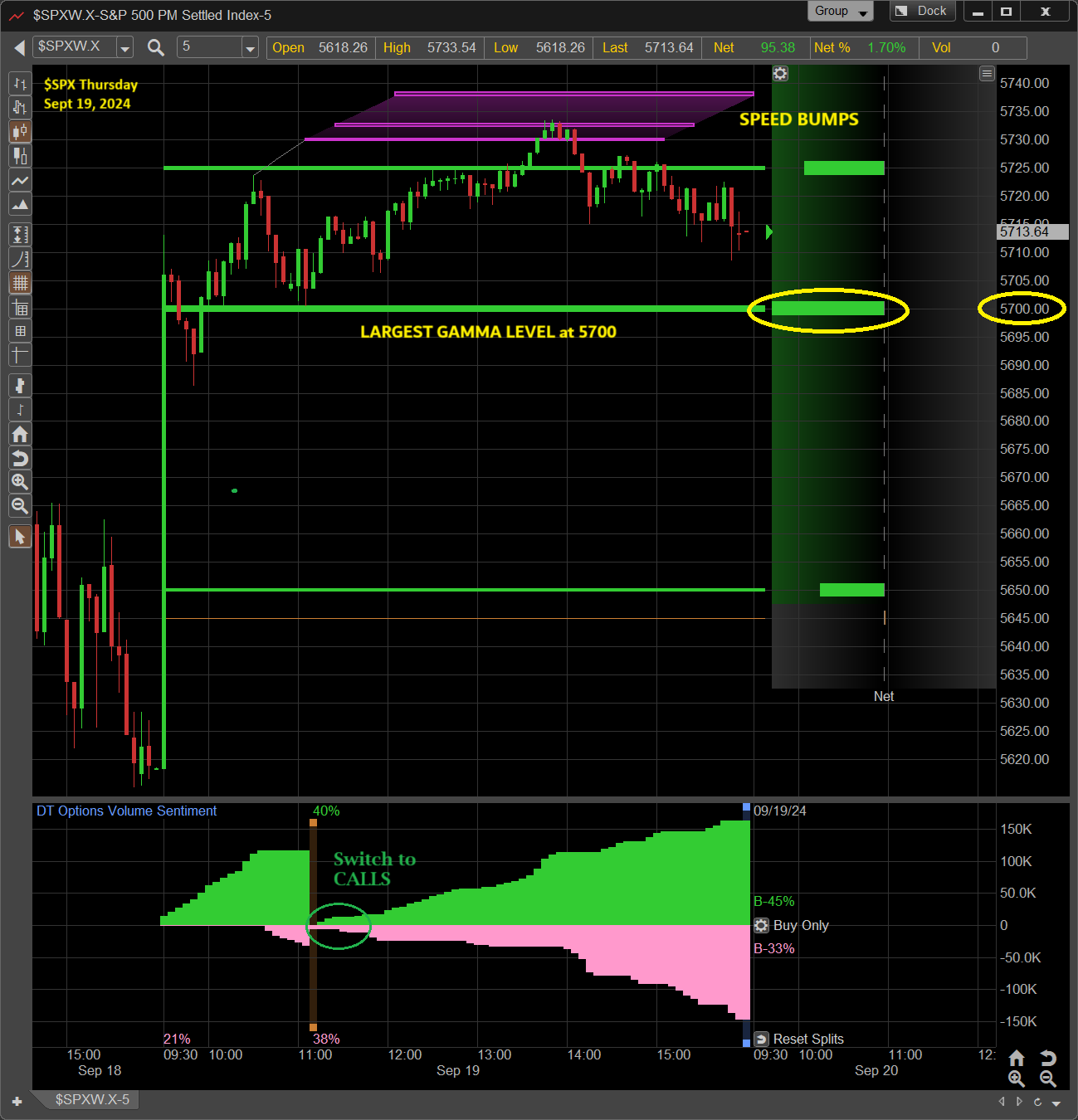

Thursday September 19th - $SPX

Dynamic Trend Gamma

Thursday September 12th - $SPX

Dynamic Trend Gamma

Thursday September 12th - $SPX

Dynamic Trend Gamma

Wednesday September 11th - $SPX

Dynamic Trend Gamma

Monday September 9th - $SPX

Dynamic Trend Gamma

Friday September 6th - $SPY

Sign up for a FREE live weekly webinar at:

Dynamic Trend Gamma

Wednesday September 4th - $SPX

Sign up for a FREE live weekly webinar at:

Dynamic Trend Gamma

Tuesday September 3rd - $SPX

Sign up for a FREE live weekly webinar at: